Another key benefit of registering with Exness is the regulatory compliance and security measures in place, ensuring a safe trading environment. As a registered broker under multiple reputable regulatory bodies such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), Exness adheres to strict standards, safeguarding client funds and providing transparency in all operations. Additionally, the broker offers negative balance protection and segregated accounts, further securing client investments. With these assurances, traders can focus on building their strategies and executing trades without concerns over fund safety or execution reliability, ultimately contributing to a more confident and informed trading journey.

How to create an account with Exness trading broker

Creating an account with Exness is a straightforward process, but it’s essential to follow each step carefully to ensure a smooth experience. Below is a detailed guide on how to set up your account from start to finish, covering all the necessary steps, including registration, verification, and configuring your trading environment.

Step 1: Visit the Exness Website

Begin by navigating to the Exness website. Make sure you are on the official site to avoid phishing attempts. You can check the URL for security features such as “https://” and a padlock symbol next to the web address.

Step 2: Start the Registration Process

- Click on the “Open Account” Button: You will find this button prominently displayed on the homepage. Click on it to be redirected to the registration form.

- Select Your Country of Residence: Choose your country from the drop-down list. It’s important to select your actual country of residence, as this can affect your account features and the documents required for verification.

- Enter Your Email and Create a Password: Use a valid email address that you have access to. Next, create a strong password—ideally a combination of letters, numbers, and symbols.

- Choose Account Type: Exness offers both standard and professional accounts. Depending on your trading experience and requirements, choose the one that suits you best. The account type can also influence leverage options, spreads, and other trading conditions.

Step 3: Verify Your Account

Verification is a mandatory step to unlock all features and ensure compliance with international financial regulations. Exness typically requires two levels of verification: identity and address.

- Identity Verification: You will be prompted to upload a government-issued ID, such as a passport or national ID card. Make sure the document is clear, readable, and not expired. Exness generally takes up to 24 hours to review your submission.

- Address Verification: For proof of address, you can use documents like a utility bill or bank statement. The document must show your full name and residential address, and it should not be older than 3-6 months.

- Email and Phone Verification: A verification code will be sent to your email and phone number. Enter the codes in the appropriate fields to complete this step.

Step 4: Setting Up Security and Preferences

It’s highly recommended to enable 2FA for added security. You can set it up through an authentication app like Google Authenticator.

Navigate to the account settings and configure your trading preferences. This includes selecting the base currency for your account and setting up leverage according to your risk tolerance.

Step 5: Fund Your Account

Before you can start trading, you need to deposit funds into your account. Exness supports multiple payment methods, including bank transfers, credit cards, and e-wallets like Skrill and Neteller.

- Navigate to the Deposit Section: Click on “Deposit” in the main dashboard.

- Select Payment Method: Choose your preferred method. Note that some methods may have fees or specific processing times.

- Enter Deposit Amount: Enter the amount you wish to deposit. Make sure it meets the minimum deposit requirement for your chosen account type.

- Complete the Payment: Follow the prompts to complete the payment process. The funds should reflect in your account balance shortly, depending on the payment method used.

Step 6: Download and Configure the Trading Platform

Exness offers several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Choose the platform that suits your trading style and install it on your device.

- Download the Platform: Go to the “Platforms” section on the Exness website and select either MT4 or MT5. Download the version compatible with your operating system.

- Install and Log In: After installation, open the platform and log in using the credentials provided during registration. You’ll need your account number, trading server, and password.

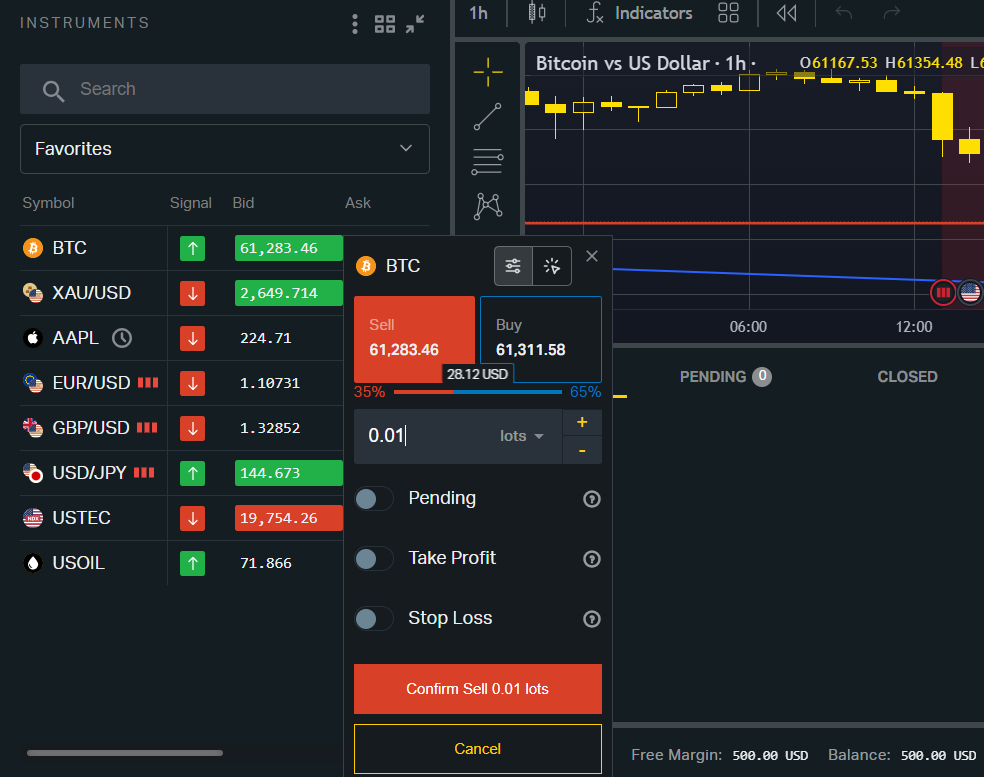

- Set Up Trading Environment: Customize the trading platform according to your preferences. This can include setting up charts, indicators, and templates for efficient trading.

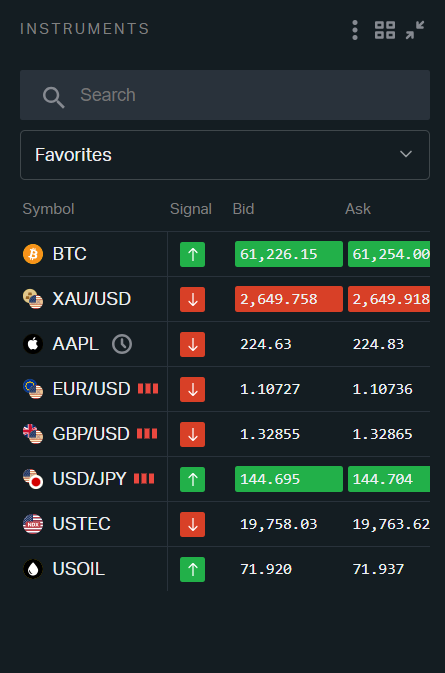

Step 7: Start Trading

With your account funded and trading platform configured, you’re now ready to start trading. Choose from a variety of assets including forex, stocks, commodities, and cryptocurrencies. Make sure to familiarize yourself with the trading conditions and fees associated with each instrument.

Creating an account with Exness is a well-structured process that ensures a secure and compliant trading environment. By following the steps outlined above, you can complete the registration swiftly and efficiently, allowing you to focus on what matters—your trading journey.

Requirements for a trader to register on the Exness trading platform

To register as a trader on the Exness trading platform, there are several key requirements that need to be fulfilled. These criteria are designed to ensure that the traders have a clear understanding of the trading environment and comply with the regulations governing financial markets. Below is a comprehensive list of the primary requirements necessary for successful registration on the Exness platform.

1. Minimum Age Requirement

To open an account on Exness, traders must be at least 18 years old. This is a standard requirement across most financial platforms, aimed at ensuring that traders have the legal capacity to enter into binding agreements and understand the associated risks of trading.

2. Personal Information and Verification

During the registration process, Exness requires traders to provide accurate personal information, including their full name, date of birth, and residential address. This information must be consistent with the documents provided for verification.

Verification involves submitting proof of identity (such as a passport or government-issued ID) and proof of residence (utility bills, bank statements, etc.). This process is in place to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Only verified accounts are allowed to trade without restrictions on the platform.

3. Email Address and Phone Number

A valid email address and phone number are essential for account creation. Exness will send a confirmation email and SMS for account activation and security purposes. The email will also be used for further communication regarding account status, updates, and promotions.

4. Account Type Selection

Traders must choose an appropriate account type based on their trading experience and investment capacity. Exness offers several account types, such as Standard, Raw Spread, Zero, and Pro, each with distinct features. Selecting the right account type is crucial as it impacts the trading conditions, spreads, and commissions.

5. Financial Information

Exness may request financial information to better understand a trader’s experience level and trading goals. This includes questions regarding annual income, employment status, source of funds, and trading experience. This information helps Exness provide tailored services and ensure that traders are using products suited to their financial profile.

Security of registration and provision of data in the broker Exness

When it comes to the security of registration and data provision, Exness broker has established a reputation for implementing some of the most advanced security protocols in the industry. This commitment ensures that clients’ personal and financial information remains secure from the moment of registration to ongoing transactions and account management.

Registration Security

Exness prioritizes security from the very first step: registration. When a new user registers, Exness utilizes high-level encryption methods to protect all information transmitted between the user’s device and its servers. This process is backed by Secure Sockets Layer (SSL) technology, ensuring that every piece of data is encrypted before it is sent, making it nearly impossible for any third party to intercept or decipher it. Additionally, Exness employs CAPTCHA systems and Two-Factor Authentication (2FA) during registration to prevent bots and unauthorized access, adding an extra layer of security for new clients.

Data Provision and Storage

Once registered, the protection of provided data becomes paramount. Exness follows stringent policies that align with international data protection regulations such as the General Data Protection Regulation (GDPR) and other local laws where applicable. This compliance demonstrates Exness’s commitment to data privacy and security standards, ensuring that all personal and financial data is stored securely.

All sensitive data provided, including identification documents, banking information, and transaction histories, are encrypted using the Advanced Encryption Standard (AES) with a 256-bit key length—one of the strongest forms of encryption currently available. Moreover, the broker separates this data into distinct, secured databases with access restrictions, meaning only authorized personnel can access such information, and even then, only under strict conditions.

Transaction and Withdrawal Security

Exness also focuses heavily on the security of financial transactions, including deposits and withdrawals. Every transaction initiated on Exness’s platforms is subjected to multi-layer authentication, where both the user and the broker must verify the process. This dual verification method, combined with identity verification procedures like biometric data or two-factor authentication, minimizes the risk of fraud or unauthorized transactions.

Exness ensures that all withdrawal requests undergo a thorough verification process. This means that clients must confirm withdrawals through a combination of password inputs, security codes sent to registered email addresses or phone numbers, and biometric confirmation in some cases. This multi-step process prevents unauthorized access, even if a user’s login details have been compromised.

Preventing Unauthorized Access

To further safeguard user accounts and data, Exness utilizes a comprehensive set of monitoring tools and artificial intelligence algorithms that continuously scan for suspicious activity. If unusual patterns, such as multiple failed login attempts or access from an unrecognized IP address, are detected, the account is immediately locked, and the client is notified. This proactive approach prevents potential breaches before they can cause harm.

Clients are also encouraged to enable Two-Factor Authentication (2FA) for an added layer of protection. This feature, when activated, requires users to input not just their regular login credentials but also a one-time code generated by an external application like Google Authenticator. This way, even if login credentials are compromised, the account remains secure.

Compliance and Data Privacy Policies

Exness goes beyond technical security measures by adhering to strict internal policies and external regulatory standards. The broker conducts regular security audits, penetration testing, and system assessments to identify and address any vulnerabilities in its infrastructure. These audits are conducted by independent third-party firms to ensure objectivity and thoroughness.

In terms of privacy, Exness has a clearly defined Privacy Policy that outlines how clients’ data is collected, used, and protected. The broker ensures that no data is shared with third parties without the client’s explicit consent, except where required by law. This transparency builds trust, as clients know exactly how their data is being handled.

Secure Communication Channels

Furthermore, all communication between clients and Exness is conducted through encrypted channels, ensuring that any shared information—whether it’s a query sent to customer support or the provision of sensitive documents—is transmitted securely. This includes the use of TLS (Transport Layer Security) protocols for all web-based communications and the employment of secure APIs for mobile apps.

Features and importance of account verification in Exness broker

Account verification is a crucial process when working with the Exness broker, as it ensures the safety and legitimacy of all trading activities. For traders, verifying their account means establishing a secure trading environment, where both personal information and funds are protected. The Exness broker requires traders to submit documents that confirm their identity and address, such as passports, national ID cards, and utility bills. This step is vital in preventing fraudulent activities, such as identity theft and money laundering, and allows Exness to comply with international regulatory standards. Without proper verification, traders may face restrictions on withdrawals and deposits, limiting their trading experience.

The importance of account verification extends beyond mere compliance. Verified accounts are granted higher transaction limits, better access to trading conditions, and enhanced customer support services. This differentiation is made to reward genuine traders who have proven their identity and to reduce risks associated with unverified accounts. For those engaged in high-volume trading, completing the verification process means gaining access to more favorable leverage options, increased withdrawal limits, and the ability to participate in exclusive promotions. Moreover, verified traders are often prioritized in case of any disputes or account-related issues, making it easier to resolve problems promptly.

Account verification at Exness is designed to be user-friendly, with a clear and straightforward process. Traders can upload their documents directly through the broker’s platform, where they are reviewed by the verification team within a few hours to a few days, depending on the complexity of the documents provided. This efficiency ensures that traders can start trading as soon as possible without unnecessary delays. Exness also offers support throughout the process, guiding users on which documents are acceptable and how to properly submit them. This guidance minimizes the chances of document rejection and simplifies the onboarding experience for new clients.

FAQ

How do I register for an Exness account?

To register with Exness, visit the official website and click on the “Open Account” button. Fill in your personal details and follow the on-screen instructions to complete the process.